Article Title: Inflation target breach

19-08-2022

Economy Current Affairs Analysis

What’s in News?

The Reserve Bank of India will call a special meeting of its Monetary Policy Committee (MPC) in October to discuss a report it will have to submit to the Union government explaining the reasons for the average retail inflation remaining above the upper tolerance limit of 6 per cent for three consecutive quarters.

RBI’s Preamble:

“to regulate the issue of Bank notes and keeping of reserves with a view to securing monetary stability in India and generally to operate the currency and credit system of the country to its advantage; to have a modern monetary policy framework to meet the challenge of an increasingly complex economy, to maintain price stability while keeping in mind the objective of growth.”

As stated in the Preamble of RBI, it is the primary objective RBI’s monetary policy is to maintain price stability while keeping in mind the objective of growth. Price stability is a necessary precondition to sustainable growth.

Flexible Inflation Targeting Framework:

In May 2016, the Reserve Bank of India (RBI) Act, 1934 was amended to provide a statutory basis for the implementation of the flexible inflation targeting framework.

The amended RBI Act also provides for the inflation target to be set by the Government of India, in consultation with the Reserve Bank, once in every five years.

Accordingly, the Central Government has notified in the Official Gazette 4 per cent Consumer Price Index (CPI) inflation as the target for the period from August 5, 2016 to March 31, 2021 with the upper tolerance limit of 6 per cent and the lower tolerance limit of 2 per cent.

The same rate is been for the next 5 financial years from 01/04/2021 to 31/03/2026.

Failure of Flexible Inflation Targeting Framework:

The Central Government notified the following as factors that constitute failure to achieve the inflation target:

(a) the average inflation is more than the upper tolerance level of the inflation target for any three consecutive quarters; or

(b) the average inflation is less than the lower tolerance level for any three consecutive quarters.

What’s Now?

The flexible inflation targeting framework agreement requires the RBI to submit a report to the Union government if it is in breach of the inflation targets for three consecutive quarters.

In eight years, this will be the first time the RBI would have let retail inflation slip beyond the upper tolerance limit of 6 per cent for three straight quarters.

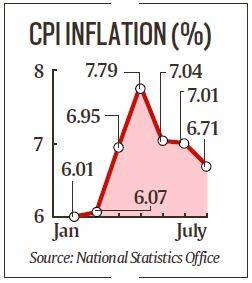

As per the NSO (National Statistics Office), the average retail inflation in January-March 2022 and April-June 2022 was 6.34 per cent and 7.28 per cent, respectively. In July this year, it stood at 6.71 per cent.

Upon failing to meet the inflation target, the RBI, would have to state the reasons for failure to achieve the target, propose remedial actions to bring it down to 4 per cent, and also provide an estimate of the time-period within which the target would be achieved.

These would be presented in a report to the Union Ministry of Finance.

It would be up to the government to make the RBI report public.

The special meeting of the MPC would discuss the RBI report before it is submitted.

Monetary Policy Committee (MPC):

Section 45ZB of the amended RBI Act, 1934 also provides for an empowered six-member monetary policy committee (MPC) to be constituted by the Central Government .

Altogether, the MPC will have six members -

a)the RBI Governor (Chairperson),

b)the RBI Deputy Governor in charge of monetary policy,

c)one official nominated by the RBI Board and

d)the remaining three members would represent the Government of India

These Government of India nominees are appointed by the Central Government based on the recommendations of asearch cum selection committee consisting of the cabinet secretary (Chairperson), the RBI Governor,the secretary of the Department of Economic Affairs, Ministry of Finance, and three experts in the field of economics or banking as nominated by the central government.

The three central government nominees of the MPC appointed by the search cum selection committee will hold office for a period of four years and will not be eligible for re-appointment.

RBI Act prohibits appointing any Member of Parliament or Legislature or public servant, or any employee / Board / committee member of RBI or anyone with a conflict of interest with RBI or anybody above the age of 70 to the MPC.

The MPC takes decisions based on majority vote (by those who are present and voting).

In case of a tie, the RBI governor will have the second or casting vote.

The decision of the Committee would be binding on the RBI.

The MPC is required to meet at least four times in a year.

The quorum for the meeting of the MPC is four members.

"UPSC-2026-PRELIMS COMBINED MAINS FOUNDATION PROGRAMME" STARTS WITH ORIENTATION ON FEB-10

"UPSC-2026-PRELIMS COMBINED MAINS FOUNDATION PROGRAMME" STARTS WITH ORIENTATION ON FEB-10